Internet Sales Tax Faces Senate Vote, 49% Of Shoppers Say They Would Change Their Habits

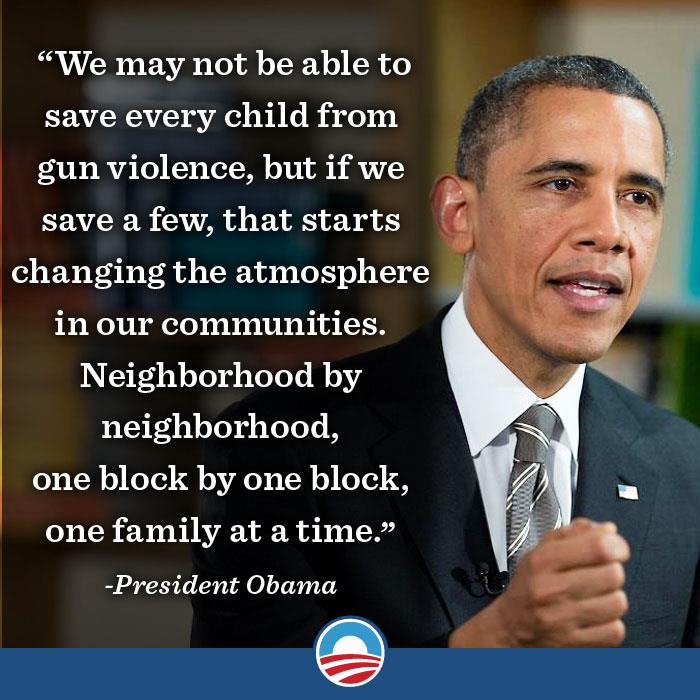

A measure that would empower states to require out-of-state retailers to collect online sales tax won backing from President Barack Obama on Monday and is expected to pass a legislative test vote in the Senate later this evening.

The bill will be the subject of a procedural motion that, if approved, will clear the way for a final vote in the Democratic-controlled Senate, likely on Wednesday.

Supporters of the measure include brick-and-mortar retailers such as Wal-Mart Stores Inc and Best Buy Co Inc and cash-strapped state governments, along with Amazon.com Inc, which hopes to simplify its U.S. state retail tax situation. Opponents include many online merchants, including eBay Inc and Overstock.com Inc.

Congressional backers say they have the 60 votes needed to end debate in the Senate. Momentum has been building since 75 of 100 senators last month voted for a non-binding version of the bill.

Prospects for the bipartisan measure are murkier in the Republican-controlled House of Representatives, where some Republicans view it as a tax hike.

Lobbyists on both sides are working to make their case in Congress, with several new wrinkles emerging on Monday, a key one being that the Obama administration for the first time officially backed the measure.

White House spokesman Jay Carney said the bill “will level the playing field for local small business retailers who are undercut every day by out-of-state on-line companies.”

Amazon, with its extensive network of distribution centers, already collects tax in nine states, and has agreements with seven more states to start charging in the next year. Amazon has been actively supporting the bill on Capitol Hill.

The bipartisan National Governors Association supports the tax, and in a letter to lawmakers on Monday said the disparate treatment of online and Main Street businesses is “shuttering stores and undermining state budgets.”

WALL STREET WEIGHS IN

In another twist to the lobbying on the issue that has gone on for years, the Securities Industry and Financial Markets Association came out in opposition to the bill. Representing big investment banks like Goldman Sachs Group, but also online companies like E*TRADE Financial Corp, SIFMA said the bill could lead to a state-level financial transaction tax and “unexpected” consumer costs.

Eleven EU countries are embracing a federal-level financial transaction tax on trading in stocks, bonds and derivatives. The Obama administration opposes such a tax for the United States.

The idea of imposing a financial transaction tax at the state level in the United States seemed  unlikely to Verenda Smith, deputy director of the Federation of Tax Administrators. She said she was not aware of any states that impose such a tax. “It’s hard for a state to even broaden their sales tax to include hairdressers,” Smith said. “I don’t want to think how hard it would be to broaden to financial transactions.”

unlikely to Verenda Smith, deputy director of the Federation of Tax Administrators. She said she was not aware of any states that impose such a tax. “It’s hard for a state to even broaden their sales tax to include hairdressers,” Smith said. “I don’t want to think how hard it would be to broaden to financial transactions.”

Under current law, states can only mandate that online merchants with physical stores or affiliates within state borders collect sales tax. Consumers are supposed to pay the tax on their own, but few even know about this.

As a result, online-only retailers often have a pricing edge over bricks-and-mortar retailers in many markets.

The legislation would extend the authority of U.S. states to online sales outside their physical borders, though it would not require them to do so. It would exempt merchants with online annual out-of-state sales of $1 million or less.

“The reason the (banks) are nervous about it is they have managed to successfully argue against their services being taxed because it is so mobile,” said Kim Ruben, an economist and director of state issues at the Tax Policy Center, a centrist think tank in Washington.